"When she was laid off in February, Patricia Guerrero was making $70,000 a year. Weeks later, with bills piling up and in need of food for her family, this middle-class mother did something she never thought she would do: She went to a food bank."

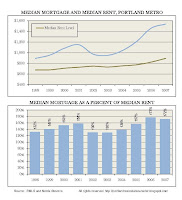

"Guerrero is estranged from her husband and raising her two young children. She's already burned through her savings to help make ends meet, and is drawing unemployment checks. She has had to take extreme measures to pay for her interest-only mortgage of $2,500 a month. In fact, her mother moved in with her to help pay the bills. Guerrero even applied for food stamps, but was denied."

On the surface it seems like a story of a middle class family falling through the cracks and getting pinched by the housing crash.

But dig deeper and you see that this was just another example of a family living way beyond its means, and finally getting caught.

According to this blog, "On the surface, this does seem like a true unfortunate soul. However, when you poke the story with a stick and say, 'boo', well, lets' just say Guerrero doesn't warrant much sympathy.

The 2,948 square foot house in question was purchased from her estranged husband's parents in August of 2002 for $202,000. By August of 2006, she and her husband refinanced this home a couple of times, finally winding up with $649,999 in debt loaded onto the house. That's close to 450k in cash out refi action in 4 years, 100k a year....and what was purchased with this so-called equity? If you watch the video that accompanies the story, Guerrero makes mention that she took off her Tiffany bracelet and left her Coach handbag in her car when she strolled into the food bank. In the photo, she is also surrounded by a sea of granite, so the 450k more than likely financed some pricey remodels as well Tiffany bracelets and Coach handbags.

Patricia Guerrero is not deserving of any sympathy because at 70k a year and being in the mortgage industry, she should have known she couldn't afford a 650k loan...even if the husband that bailed was making 70-80k himself. They may have used some 'liar loans' (stated income, no income verification, etc) to make the loan fly on paper, but in reality they bit off way more than they could afford. "

I'm sorry, but they really don't deserve to keep the house. They've basically already sold it, pulling $450k out if it, and for what? Looks like a nice kitchen remodel, a tiffany bracelet and at least one coach handbag.This woman needs to stop looking for her bailout and figure out how to provide for the kids. It's obvious there were no savings, so maybe it's time to sell the house and find a cheap rental, or sell the bracelet and the coach bag, or god-forbid find a interim job to cover some of her expenses. I'm tired of people looking for a bailout. Own up that you made a bad decision and figure out how to get out of it. Cut your expenses, figure out how to get some income, and don't make the same mistakes again.