Wednesday, April 30, 2008

New week, new open thread

Housing Authority Selling off Houses

"The Housing Authority of Portland hopes to raise $30 million from the sale of 160 scattered-site homes in Multnomah County and plans to use the proceeds to create more low-income housing.

The sale of the mostly single-family homes started in February, and seven deals have closed. Eventually, the Housing Authority wants to replace each of the units it sells, pay for deferred maintenance at the properties it currently owns and, perhaps, create 175 additional units.

But according to Mike Andrews, the Housing Authority's director of development and community revitalization, "it's clear to us that the $30 million is not enough to accomplish all three goals.""

I can't help but wonder if they see this as the peak of the market, and thus a great time to buy. Or if the timing is jsut coincidence. I do know that the house we looked at was bought for $20k 20 years ago and is now listed at over $300k. Not a bad return for their investment.Tuesday, April 29, 2008

Portland Home Prices Continue Falling - Case Shiller

The median price of existing homes in

The median price of existing homes in The chart also shows what looks to be a small plateau at the end of last year. This is likely due to the seasonally slow months, and seller holding out for better pricing in the spring. When that didn't materialize buyer's relented and dropped their price.

The median price of existing homes in Portland is now lower than it was in June 2006, wiping out over a year and a half of appreciation.

The median price of existing homes in Portland is now lower than it was in June 2006, wiping out over a year and a half of appreciation.

This chart shows the median price over the past three years, making it easier to see the comparison to April 2006.

Nationally, the 20 city index declined 12.7% in February and shows no signs of slowing. While prices in other regions around the nation are well on the way towards correcting (see the recent

Nationally, the 20 city index declined 12.7% in February and shows no signs of slowing. While prices in other regions around the nation are well on the way towards correcting (see the recent My advice for sellers? Look at where similar houses were selling in the Spring of 2006 (not 2007) and price 5-10% below that, or else you risk following the market down even further.

My advice for buyers? Look at where prices were in the Spring of 2006, and offer 5-10% below that. Or just wait, those prices will be here soon enough.

ABOUT CASE SHILLER:

The Case Shiller data focuses on the change in price of existing homes, and tries to exclude the effects of remodeling, or major damage. It tries to exclude investment properties and foreclosures (which would make the data look worse) as well as transfers between family members. It's a much better indicator of how the price of the average or typical house has changed from year to year. For full details on their methodology see their factsheet.

Monday, April 28, 2008

17% off - 1420 NW 20th Ave Unit: 501

Thanks to Stephanie for sending in an email about this condo with the note: "Here's a condo in the downtown area. It looks like it sold for $525,300 in April 2006 (per Portland Maps). It's on the market today for $436,999. What's the story on this?" MLS#8018072

That's a 17% decline in one year. Ouch.

It doesn't appear to be a foreclosure, at least I couldn't find it on RealtyTrac.

Based on Portland Maps the property tax jumped from $1890 in 2006 to $6100 in 2007.

Is this a sign that the condo glut is starting to push down prices? I don't know anything about this building, any readers know more?

Sunday, April 27, 2008

Portland 41% Overvalued

"Bend, Oregon tops the overvaluation list, at 59%. Miami, at 44% is the largest city at significant risk, while Honolulu, Portland, OR, and Riverside-San Bernardino also exceed the 32% threshold. Los Angeles, Seattle, and Phoenix are notably close to that mark. Another way of measuring the degree of overvaluation is by the share of the total housing market meeting the criterion of overvalued. For example, at its peak in the second quarter of 2006, 20 percent of all housing units in America were in metro areas classified as overvalued. By the fourth quarter of 2007, however, that figure dropped to a modest 4 percent. When looked at in market value terms, overvaluation peaked at 39 percent during the fourth quarter of 2005 and the second quarter of 2006. However, that measure has also fallen dramatically, to just 7 percent during the fourth quarter of 2007. Essentially we have, in a scant six quarters, reversed the overvaluation generated since the last half of 2004."

While Bend gets top honors, Portland isn't far behind, taking the #11 spot (out of 330 metro areas) at 41% overvalued.

Most other markets have corrected fairly quickly, so I would expect Portland to also correct over the next 6-8 quarters.

The full report is located here.

In the words of one blog reader: "Portland has been in denial about the inflated value of housing. This should be the most deafening wake up call yet." I totally agree.

Here's a quick note about their methodology: "Our approach to determining statistically normal house values considers not only house prices and interest rates, but household incomes, population densities and any historical premiums or discounts metropolitan areas have exhibited over time. We examined these factors for 330 metro areas now accounting for 78 percent of all existing housing units in America and 93 percent of all related real estate value, to determine what house prices should be, in this statistical sense."

Thursday, April 24, 2008

Are Relistings Inflating Values?

Let's assume it sells at the lower price. The spread between listing and asking price will show as 0. But if it had remained at $314k and just the price reduced the spread would be 6%.

So for those trying to chart the spread between listing and selling price as an indicator of where the market is moving, we now have another skewed statistic.

I haven't had a lot of time to think this through, so what are your thoughts? Is this meaningful? Any Realtors care to comment?

Housing Bailout Backlash Growing

CNN Money has another article today featuring Patrick Killelea from patrick.net, as well as from stopthehousingbailout.com entitled: "Backlash grows against the housing bailout".

"Why should American taxpayers have to pay to bailout reckless lenders and borrowers?

The website Angryrenter.com, launched just last week, has a vitiation demanding that Congress not pass any bailout programs that reward risky borrowing and lending. To wit: "Let the free market sort it out!""

"A third of the American public rents," Brandon pointed out. "They're saying 'I've been saving for a mortgage for years. I could have jumped in on a subprime loan too. Now I'm going to have to pay for a government bailout.""And from fellow blogger Patrick Killelea

"Patrick Killelea has been blogging about the housing bubble at Patrick.net for four years from San Francisco, where it takes a not-so-small fortune to buy.

"Bailouts reward bad behavior. I've been diligently saving, denying myself lots of things so I can afford to buy, yet the government is saying we have to keep all these people in their homes," said the Web site programmer and author. "Well, wait a minute! Why can't I spend more than I can afford and have the government bail me out.""

I have added a link to the petition in my blogroll. If you oppose any bailout, please sign their petition.Unfortunately in this election year (or at any time for that matter) it makes better press to help people "save their house", even when they can't afford that house. The rest of us would be better off with lower prices so more people can afford homes, but our guvmint will likely mess this up as usual. Giving tax breaks to home builders for example, our lobbyists at work! Argh!

Wednesday, April 23, 2008

Reader Sightings – 1734 SE 34th Ave

1734 SE 34th, MLS #8036153 .

A reader sent in this SE bungalow with the comment: "Seems like hell of a steep price for this home." I'd have to agree.

It sold in Juan 2006 for $335k, then a year later for $584k, a 75% increase in one year. Must have been a heck of a remodel.

It's currently being sold by the bank after a foreclosure repossession. The previous owner was 100% financed and I assume just walked away. I'll be curious to see what the bank gets for it. I hope they cut the lawn.

Tuesday, April 22, 2008

Happy Earth Day!

I thought I'd take a break from being a real estate voyeur and analyst to celebrate Earth Day today.

In the past few months my wife and I made a few small changes in our behavior, then watched them snowballed into a few major changes. Call it the power of commitment but once we decided we could do more to be "green" we started finding other small and not so small changes we could make that would help reduce waste or energy.

The tipping point seems to be the purchase of a travel coffee mug that doesn't leak. We saw the mug our babysitter used and my wife went out and bought two, one for each of us. She now takes hers with her to school and uses it instead of a disposable cup. Not really a huge change, right? But that one step seems to have cemented our commitment.

Soon after we made a few more significant changes:

- Switched our daughter over from disposable to cloth diapers

- Bought a composter and set it up

- We found out that we could recycle plastics at Metro in the outer NE Portland, so we bought two bins (one for containers, one for plastic foil) and started collecting our plastic to recycle.

- I started biking to work more regularly, 4 days last week.

- Looking into building a rain catchment system (at our rental house) to help use rainwater to water our plants.

We have seen a measurable decrease in our weekly trash with these changes, and frankly the biggest benefit of me biking to work is that I feel better and I know I'm in better shape (40 min a day of biking will do that!)

Living "green" had definitely hit the mainstream in the past few years. So what are you doing differently? Got any tricks you want to share?

Or do you think it's all BS and we're all just doing this to feel better without making any real difference?

Either way, happy Earth Day!

Monday, April 21, 2008

The Great Ponzi Scheme

Frankly I have very little sympathy for "homeowners" who put no money down on funny money mortgages and are now losing their homes. I feel like they were basically renting the house at the bank's expense. But Paul McCulley stated it much better than I could, using financial terms. Here's an excerpt:

"Paul McCulley of Pimco, the big bond manager, gave an interesting speech in which he said the recent subprime mortgage fiasco proceeded to a fourth level — one that he called “Ponzi-squared” — before it collapsed.

At the end, he said, the marginal subprime loan was:

No money down

No documentation of income

Initial below-market teaser interest rate

Negative amortization

That is not a loan, he said. Instead, it amounted to giving the home buyer a call option to buy the house at the current market price, coupled with a put option to sell the house back at that price.

If house prices kept rising, the “buyer” could make the small interest payments to keep the option open, and eventually sell the house. That happened for a time, and led to the conclusion by rating agencies that such borrowers were good risks.

But when prices went down, the “buyer” would suffer no loss if he exercised the put and gave the house to the lender. That is just what happened."

I do sympathize with those that are facing foreclosure due to hardship, disability, or other unfortunate events. But I believe that the majority of those facing foreclosure today have never truly "owned" their homes. They speculated on an investment and lost. Just as I have lost on a number of investments I have made over the past 10 years. (hello internet stocks!).Friday, April 18, 2008

Reader Sightings: 5838 NE 14th

Here's another reader sighting:

12 SW Lowell, MLS #8003377

"Bought in 2004 for $380K, now selling for $300K. That’s a 21% decrease!"

My favorite quote: "No Yard to Maintain!" It's like a condo, but it's not!Here is a link to more data on Trulia.

So who can find the largest price decrease out there? I think I'm in the lead with 45%, I'll have to go check. Post them in the comments, or send me an email and I'll post them up.

I'm also happy to post the biggest increases, coming soon!

Tuesday, April 15, 2008

March RMLS Data and Analysis

The median price in March was basically flat, up only 0.6% Year over Year, and up 2.7% from February. Year over year growth has basically been flat for three months now.

Inventory as measured by the absolute number of homes on the market rose again in March for the third straight month, nearing 15,900 units. So while inventory in terms of months has fallen since January as a result of a more accelerated (seasonal) sales pace, the total number of sellers on the market has increased. In other words, the rate of sales in the first quarter has yet to keep pace with new additions to the market. The rate of sales is down 39.1%, and I believe that the lack of buyers will eventually drive down prices.

Inventory as measured by the absolute number of homes on the market rose again in March for the third straight month, nearing 15,900 units. So while inventory in terms of months has fallen since January as a result of a more accelerated (seasonal) sales pace, the total number of sellers on the market has increased. In other words, the rate of sales in the first quarter has yet to keep pace with new additions to the market. The rate of sales is down 39.1%, and I believe that the lack of buyers will eventually drive down prices. The affordability measure in the metro area fell in March for the second straight month. This was partially the impact of a monthly increase and median prices [$280,000 in (Feb 08) vs. $286,500 (Mar 08] and a slight uptick in the average 30-year FRM.

The affordability measure in the metro area fell in March for the second straight month. This was partially the impact of a monthly increase and median prices [$280,000 in (Feb 08) vs. $286,500 (Mar 08] and a slight uptick in the average 30-year FRM. The results of this figure are deceiving. This chart calculates the spread of listing to sales prices in an attempt to measure seller optimism (or reality). While the results for March indicate a narrowing spread, this was the result of a higher sales price and stagnate listing prices. This would indicate that on average--at least in March, that buyers came back to the sellers in terms of price and not vice versa.

The results of this figure are deceiving. This chart calculates the spread of listing to sales prices in an attempt to measure seller optimism (or reality). While the results for March indicate a narrowing spread, this was the result of a higher sales price and stagnate listing prices. This would indicate that on average--at least in March, that buyers came back to the sellers in terms of price and not vice versa.Chris also added a couple cool new charts and some more detailed analysis this month.

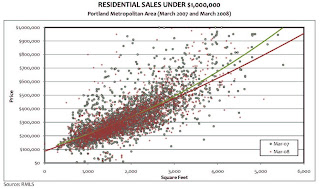

This is a cool visual that scatter plots all sales under $1,000,000 by price and sq. ft. The trendlines would indicate that prices have in fact remained roughly consistent year over year.

This is a cool visual that scatter plots all sales under $1,000,000 by price and sq. ft. The trendlines would indicate that prices have in fact remained roughly consistent year over year. This chart shows the distribution of sales by price cohort. Using $300,000 as a benchmark there was a slight 1.1% shift toward higher priced homes (Above $300,000) obviously accounting for the modest uptick in median price.

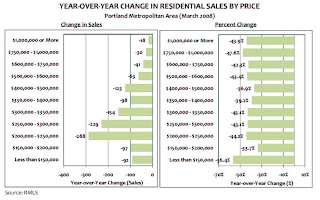

This chart shows the distribution of sales by price cohort. Using $300,000 as a benchmark there was a slight 1.1% shift toward higher priced homes (Above $300,000) obviously accounting for the modest uptick in median price. This chart displays the year-over-year change in sales pace by price point. This chart allows us to measure which cohorts of the market are seeing the biggest slowdown. The 56% decrease in homes below $150,000, and to a certain extent $200,000 to $300,000 is an indication of marginal or first time buyers either waiting it out or failing to get financing.

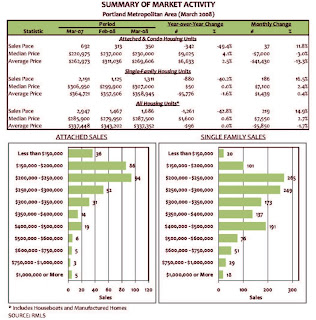

This chart displays the year-over-year change in sales pace by price point. This chart allows us to measure which cohorts of the market are seeing the biggest slowdown. The 56% decrease in homes below $150,000, and to a certain extent $200,000 to $300,000 is an indication of marginal or first time buyers either waiting it out or failing to get financing. A summary of market activity by product type. (Note from Chris: Note that RMLS issued a section on condo appreciation that listed an average condo sales price of $336,500 for March 2008. I am fairly certain this is a miscalculation). Not how the average sales price in the market is no longer increasing. In my opinion this would suggest that tightening in terms of pricing is starting to occur.

A summary of market activity by product type. (Note from Chris: Note that RMLS issued a section on condo appreciation that listed an average condo sales price of $336,500 for March 2008. I am fairly certain this is a miscalculation). Not how the average sales price in the market is no longer increasing. In my opinion this would suggest that tightening in terms of pricing is starting to occur. This data differs from the data reported in the RMLS Market Action. The RMLS likes to report the last 12 months vs the previous 12 months, and based on this methodology it appears that the average price is still increasing. I believe our method here is more accurate, and more clearly shows changes in growth, both up or down.

It shows inventory in terms of months (using the Realtors calculation) by price point. Good luck selling your $600,000+ home.

It shows inventory in terms of months (using the Realtors calculation) by price point. Good luck selling your $600,000+ home. This chart shows median sales price and sales pace by subregion. Next month we'll get to year over year changes.

This chart shows median sales price and sales pace by subregion. Next month we'll get to year over year changes.Again a big thanks to Chris for all this analysis.

Monday, April 14, 2008

Hey, it's the new REMAX bubble!

" MAX EQUITY ROUNDTABLE SUGGESTS POSSIBLE “NEW REAL ESTATE BUBBLE” THEORY"

Here's an excerpt. Warning: Please put down anything you might be drinking, or else you might end up spiting it all over your PC due to spontaneous laughter.

"BEAVERTON, Ore. — Is a new real estate bubble forming? Executives at RE/MAX equity group think so. Gary Taylor, principal broker at the firm’s Sunset Corridor office and head of the company’s panel who studied recent market data and the prevailing theory, recently released the panel’s findings.

Local brokers are seeing steady sales through this “new market”. Last month the Portland Metropolitan area had 1,384 closed sales, up 27.6 percent from January 2008 (1). What the brokers are hearing is a real demand from individuals with a sincere desire to buy, but limiting factors are hindering their ability to execute a transaction."

Ah yes, the old monthly sales increase ruse. What they forgot to mention was that sales in Portland were DOWN 29% year over year. The February bump is seasonality, it happens every year. Yawn."Some of the factors that the panel identified in the current market:

Contingencies. Brokers are seeing a higher than normal amount of contingent offers, relative to total sales. These contingencies usually include the potential buyer’s ability to sell their primary residence."

Ah I see, this is a "wishful thinking" bubble. I wish I could sell my house, so I could buy a bigger house. The reality is, with no entry level buyers thanks to the elimination of funny money and zero down loans, others can't trade up.

"Deals, Deals, Deals. Brokers are hearing from their clients that are confident that the market may have hit bottom and is on the way back up. This has resulted in buyers acting on aggressive marketing tactics from local builders, as well as sellers trying to market their property. "

This would be the "hearsay" bubble. We hear there are buyers out there! Of course people are acting on builder incentives, I might be tempted by 50% off too!

"Financing Woes. The tightening of the ability for many to get mortgages may be true, but that has not affected the desire of buyers. In the last two years, there have been nearly 2 million new households formed (3), and it’s likely they will soon be in the home buying market. "

More wishful thinking. Those new households now need real savings to buy a house, and most people don't know the meaning of savings.

Gary Taylor and his team must be real geniuses to spot this bubble before the rest of us, I'd like to thank him for bringing it to our attention!

By request - an open thread

1. Please try to reference the previous post you're commenting on.

2. Keep it civil. Attack the argument, not the person.

3. I will delete abusive posts or foul language.

That's it. So what's on your minds. Here's one to start: The cold war was neither cold, nor a war. Discuss.

Kidding...

Friday, April 11, 2008

Portland insiders see signs of improvement?

Thanks to Ryan for asking one of the 10 or so questions I sent in. Here are a few of my favorite comments.

"At a housing industry lunch forum, the brokers said they started noticing fewer potential buyers visiting their listings about last April.

The evidence that the bottom is near?

Brokers point to the fact sellers are finally willing to give up a bit on their price to sell faster. They also point out that real estate insiders themselves are now snapping up investment properties."Really? They're snapping up investment properties? Show me one. Nothing concrete was mentioned in the article.

Nothing I analyzed last year (2-4 unit buildings) made a positive cash flow with 20% down, most would need 40% down, and then you're looking at a 1% return on your investment. Unless you include speculation on price inflation, but that looks to be over. So I predict prices will have to soften to come back in line where investment properties actually provide a decent ROI and cash flow without hoping for 10% YoY appreciation.

But let's look at a concrete example. Here's a four plex for sale for $415k. With a 44% down payment ($182k) you're looking at a 0.06% cash on cash return. That's not 6%, that 0.06%!

I know interest rates are in the proverbial toilet, but even my savings account pays more than that.

If there are good deals out there, this outsider hasn't found them. You must need to be an insider.

Here's one of the questions I submitted to Frank:

"Why are Realtors afraid to admit the market is softening and will likely decline over the next few months?

"It has," one broker said.

"It's all past tense," another said.

"It has declined," Davies said. "It has softened. But actually the last 60, 90 days have been just like they were last year. It's very active."

Becky Jackson at Realty Trust Group Inc. in the Pearl District said: "When you're speaking to a buyer today you may not be able to say perfectly that it has passed. You might still see something for the next few months but you're not going to know what is the last day of the low market."

Just like they were last year? Sales are down 30% from last year, that's "just like last year?"It's all past tense? Wishful thinking again. It's all future tense! The decline has just started here.

"Kathy MacNaughton of Realty Trust Group said: "What you say privately and publicly is different."

"How so?" I asked.

"I don't think it does you any good to say the market is tanking. And it's not. We know that. You've heard that today. But I will tell you that probably six months ago I talked to my buyers privately and said, 'You know what, we have to be very careful. I see signs in this market of settling.' And I think all of us did the same thing.""

Prices might not have tanked, but I would say that a 30% decline in sales is pretty much tanking. I know in my industry if we were down 30% from last year I, and 75% of my coworkers, would be out of a job. And if I told my manager that a 30% sales decline was just like last year I'd be fired on the spot.Thursday, April 10, 2008

Reader Sightings: 5838 NE 14th

"Listed at $270K, bought for $305K in 2006… ouch.

5838 NE 14th Ave, Portland

More details"

I also like Trulia's new feature that incorporates Google Maps into the page, which makes it easier to see if there is an ugly monstrosity next door.

I swear I'm seeing more and more short sales these days. I know they make up about 5% of the local market, but it seems like there are more out there.

Wednesday, April 9, 2008

Tracking the NAR's Spin and Lies

It's ever funnier (or scarier) when you put this chart together with the recent news that Lawrence Yun (the NAR's cheif economist) was named as one of America's top economic forecasters.

And just so we're all on the same page, I'll believe we will have hit bottom when we see the sales decline plateau and start increasing, and inventory stop increasing. Prices will rise after that.

And don't forget, two data points is just a line. Three is a trend.

Tuesday, April 8, 2008

Stop the mortgage bailout on NPR Wednesday

"Hi all. ?Thanks for your efforts against the bailout. ?We have good news; as a direct result of all of your hard work, the media is finally starting to wake up to the reality that there is side to the bailout other than the cheerleading that is currently the mainstay. ?

Monday, April 7, 2008

Would you buy a house from this Realtor?

Here's another incredible story of a couple about to lose their house, and the amazing part is that the woman is a Realtor and should know better.

A larger than life mortgage.

The analyst kicks in at about 2 min 45 seconds into the story, and basically lays into them.

The cliff notes version:

- Couple buys house in Livermore CA for $1.5M

- Couple elects to take a negative amortization ARM, and only pays $2800 a month

- Full mortgage payment is equal to 70% of their gross income

- Couple racks up an additional $100k in finance charges on $1M loan, which is added to principle

- Principle reaches 110% of original loan value and bank requires them to pay full monthly payment.

- Payment jumps to $8000 a month

- Couple freaks out, asks to renegotiate loan at 2% for 40 years!

- Bank offers 5.75% for 38 years, or a $6000 payment

- Couple still can't afford mortgage at a rate most would be thrilled with

Again this couple wants us to feel sorry for them, but in the video she admits freely that she didn't read the loan paperwork. I also believe they were speculating, as even if they refinance to a 38 year fixed loan (as the bank offers) they still can't afford the mortgage.

I'm scared to think of how many customers she offered "advice" when she obviously has no clue what she's doing herself.

The value of this house has now fallen about 30% to roughly $1M, so they're looking at foreclosure, but vow to "fight it". Right.

I swear, I couldn't make up stories this crazy. I'm just not that creative!

Saturday, April 5, 2008

Trying to Get Away

On the front page of the Seattle Times today was this story:

http://seattletimes.nwsource.com/html/realestate/2004329266_homesales05.html

A few excerpts:

"Last month King County saw 37 percent fewer houses sell and prices fall 3.3 percent compared to March a year earlier. The real-estate market was no stronger in surrounding counties, the March sales-activity report released Friday by the Northwest Multiple Listing Service shows.

But here's the riddle: With buyers edgy and more homes for sale, why aren't prices dropping more? In fact, after being essentially flat since November, King County's house prices actually ticked up $10,000 from February to $439,900.

The reason for the relatively modest year-over-year price decrease, real-estate economists say, is sellers' unwillingness to cut prices. Economists call it "stickiness.""

The article focuses on "stickiness" and offers a few insights into why prices haven't dropped yet, including emotional ties to the house, and owing more than the house is worth.

"A study by economists Karl Case and Robert Shiller, who also author the S&P/Case-Shiller Home Price Indices, reveals just how strong the reluctance to discount is.

It asked sellers: "If you had been unable to sell your home for the price that you received, what would you have done?"

• 37 percent said they would have "left the price the same and waited for a buyer."

• 28 percent said they would have turned their home into a rental rather than sell for less.

• Fewer than 5 percent said they would have "lowered the price until they found a buyer."

Realistically, however, some sellers cannot lower their price, observes John Kilpatrick, president of Greenfield Advisors, a Seattle economic-analysis firm.

They're the ones who bought recently with little or no money down or the ones who refinanced the equity out of their homes just as prices slumped.

"The price is sticky because oftentimes they owe more than they could sell the house for," Kilpatrick says.

These sellers feel they must hold firm -- or take their home off the market and wait for conditions to improve.

"There's an old saying, 'Price drives everything.' But I'm not of the opinion that sellers are at that point yet. They're resistant," says Paula Fortier, the broker in Coldwell Banker Bain's Bellevue office.

Adds Mike Skahen, owner/broker of the Seattle real-estate firm Lake & Co., "Sellers are kind of stubborn, but the ones who are realistic are getting their homes sold."

He cites the recent sale of a North Seattle house originally listed for about $695,000. It sold three price drops later for $578,000.

Then there's the seller who thinks the condo he bought last year is worth 10 percent more. Not only will buyers not bite, but Skahen says agents may not either. "We've been known many times not to take listings where the sellers won't be realistic," he says.

While this many seem bleak to sellers, Kilpatrick, who holds a doctorate in real-estate economics, senses the situation is only temporary.

"The good news is homes are still valuable commodities," he says. "Prices are depressed, but I suspect as this shakes out -- and I suspect it will shake out in 2008 -- you'll see the market rebound.""

What seemed to be missing from the piece is what happens to those houses that are worth less than the mortgage. If the owner has an ARM that resets and they can no longer afford the payments, but they can't sell, it goes into foreclosure. A year later the bank owns it and will likely fire-sale it for 20% or more off, driving down prices.

Or if the builders can't sell but need cash to function, they'll have no choice but to drop prices to unload the properties.

So I really doubt the market will rebound in 2008, and I'm surprised to hear this from a PhD. in Real Estate Economics. More and more foreclosures are coming on the market and they will drive down prices at least in Portland and I'm sure in Seattle as well.

If I'm wrong, I'll buy him a coffee, but I don't predict a rebound until at least 2009 at the earliest.

Friday, April 4, 2008

Free Fall Friday - All of Portland?

I have some doubts about his methodology, but I give them props for going on record as predicting a decline, and I imagine they will soon be run out of town by the Portland NAR.

Tuesday, April 1, 2008

More (un)worthy subprime fallout victims

"We're still both in shock that it could go from something so good to so bad so quick," said Kent, 59. "New Century in 60 days went from top of the heap to out of business."

The two didn't say exactly how much money they made at their last jobs but Kent admitted they each had six-figure incomes.

Today, they're trying to get by on his unemployment benefits of about $450 a week, which covers only about an eighth of the basic payments they owe every month."

"Their home equity line, mortgage, health and life insurance premiums alone cost about $10,000 a month. Still, they are trying to hang onto what they call their dream home with a view of the Pacific Ocean where they live with Mysti's 11-year old son.

Kent estimates the mountainside home in San Clemente, Calif., which they bought in 2005, is worth 20% less than it was a year ago. And in the current market, he said he's not sure he could sell it for even that amount.

"We've used up most of our reserves, cashed in her 401K," said Kent. "We're going Mach 1 into a wall. When we run into it, then we've got to decide what to do next."

Despite their financial problems, the Copes have worked hard to protect their credit rating, staying current on bills. And they've made cutbacks: trading in Kent's Corvette for a Suburban and getting rid of the gardener, for example. But the couple also has learned that it didn't need everything it used to spend money on."

I lived in San Francisco and was laid off when the the dot-com bubble burst and felt the pain of going from a comfortable salary, to unemployment that doesn't even cover your rent so I know that frustration. I had to wait for my lease to expire to find a cheaper place to rent, but I was able to sell my car, found a free place to stay in exchange for work, and sponged off my girlfriend (now wife) for a few months while I enjoyed a relaxing summer looking for a new job.But their cutbacks? "And they've made cutbacks: trading in Kent's Corvette for a Suburban and getting rid of the gardener, for example." They ditched the gardener? And sold the 'vette for a Suburban? That's economizing? How about selling the Vette and sharing a car? Or at least buy a corolla, or anything that gets more than 10 MPG.

I'm also amazed at the number of people who are cashing in their 401k's to prop up their extravagant lifestyles. I've already given up any expectations of seeing my social security in 30 years, but after bailing out the banks and the homeowners who overextended themselves, in another 20 years I'll be bailing out the homeowners who sucked their retirement dry in exchange for an ocean view and granite counter tops.

I need to stop reading the news, this is getting depressing.