The January Case Shiller data was released this morning and January's median price for an existing home in Portland was down 14% from January 2008. (click on any chart to expand it to readable size)

The January Case Shiller data was released this morning and January's median price for an existing home in Portland was down 14% from January 2008. (click on any chart to expand it to readable size)The monthly change was even worse, down 3% from December, beating December's month over month 2.5% decline.

The median Portland home price is now down 17.5% from the peak in July 2007.

The chart above shows the price index for the past three years. You can clearly see that prices have now dropped to levels not seen since July 2005 and they continue to fall.

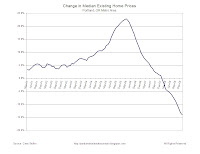

The above chart shows growth rates for Portland, Seattle, the San Francisco bay area (the other areas I consider as closest to Portland) as well as the 20-city composite index. Portland and Seattle are tracking each other very closely, still about a year behind the rest of the market.

While the price index continues to fall everywhere, the growth rate (or decline rate) for the 20-City index as well as for the San Francisco Bay Area markets appears to have reached an inflection point. We need a few more months of data before calling it a trend, but it looks like there are signs of a bottom approaching for the Bay Area as well as the entire country.

This chart shows the price index for the past 8 years. I also added a line in pink this month that represents Portland's average 6.6% growth starting in September 2000. You can see that the current price index is now well below the historic growth line which tells me that our historic growth rate is not sustainable, given that it's nearly double the rate of inflation. Others will try to use this data to show we've reached the bottom (or passed it) I'm sure.

This chart shows the price index for the past 8 years. I also added a line in pink this month that represents Portland's average 6.6% growth starting in September 2000. You can see that the current price index is now well below the historic growth line which tells me that our historic growth rate is not sustainable, given that it's nearly double the rate of inflation. Others will try to use this data to show we've reached the bottom (or passed it) I'm sure.

This chart is more for historical curiosity than anything. It shows the previous bubble in the early 90's, and also shows that Portland prices had never dropped over the past 20 years, until 2008. But as they say, past performance is no guarantee of future performance!

ABOUT CASE SHILLER:

The S&P/Case-Shiller Home Price Indices measures the residential housing market, tracking changes in the value of the residential real estate market in 20 metropolitan regions across the United States. These indices use the repeat sales pricing technique to measure housing markets. First developed by Karl Case and Robert Shiller, this methodology collects data on single-family home re-sales, capturing re-sold sale prices to form sale pairs. This index family consists of 20 regional indices and two composite indices as aggregates of the regions.