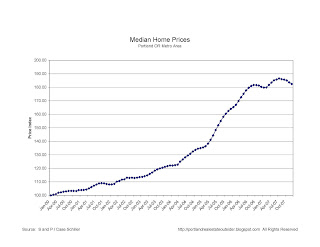

I've clipped the chart for Portland, but I encourage you to go play with the chart on their site.

An outsider's view of the Portland, OR real estate market.

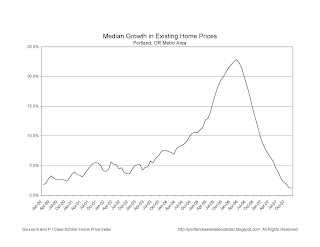

Year over year growth slowed slightly from 1.3% to 1.2%, but is surprisingly still positive.

Year over year growth slowed slightly from 1.3% to 1.2%, but is surprisingly still positive. Don't forget that this data is backwards looking, and almost two months old at this point. Given today's economic indicators I expect things will continue to get worse.

Don't forget that this data is backwards looking, and almost two months old at this point. Given today's economic indicators I expect things will continue to get worse.

""I think home prices are going to continue falling, so I see no compelling reason to buy a home right now when we can hold off and buy at a lower price later this year or early next year," she said.

Economists tend to agree. Housing markets in some parts of the country will suffer drops of more than 30 percent before the housing crisis is over, according to a report in December by Moody's Economy.com."

""The economic fundamentals in housing are weak and I see no sign of a bottom," said Chris Mayer, director of the Paul Milstein Center for Real Estate at Columbia Business School in New York."

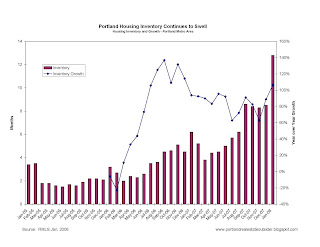

My first reaction after seeing the January RMLS statistic was something along the lines of “Holy cr@p, the market has imploded!” But after analyzing the data a bit more I realized that the past few Januarys have seen significant jumps month to month. So even though months of inventory jumped another 50% this month, that's not unusual for January. Given the historical trends, I expect the months of inventory will drop in February, so don’t be fooled with the realtors all crow about how months of inventory has peaked and is now dropping.

The trend to keep an eye on is inventory growth. While the total inventory is shocking, the fact that the growth rate has also increased over the past few months shows that the market continues to get worse.

I’ll post more comments once I’ve analyzed the data a bit more closely.

We had some good friends over for drinks this weekend and, as usual, talk turned to real estate. We mentioned that we’ve had our eye on a house that is currentlyfor sale in their neighborhood, and not only did they know the house, they knew a bit about the owner. Their comments were:

"That house is owned by Mary (not her real name). She made a bunch of money as a mortgage broker and bought six investment properties over the past few years. Her income has dropped recently and so she's trying to thin out her holdings and she listed that house a few months ago. Her original plan was to fix it up to get top dollar, but now she's just hoping to get out from under it fast. She's already dropped the asking price once, and will probably drop it again."

I can't help but think we're going to see more and more stories like this over the next few months (and years). If you were a buyer interested in this house, what would you do? Wait? Submit a lowball offer?

| |