Wow, I miss one month and everything goes crazy. Back in July we were looking at 3 months of price increases. Prices peaked in August, but fell a bit again in September. I would expect prices to continue to increase through the end of the year, so we'll see where they go in October.

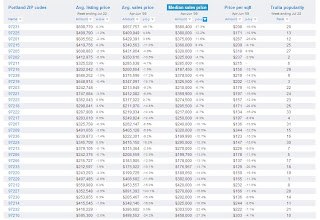

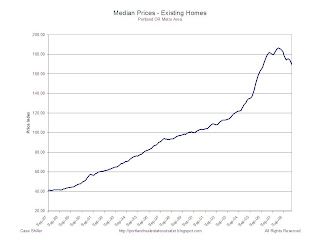

September's median price for an existing home in Portland was down 11.8% from September 2008 at 149.72. (click on any chart to expand it to readable size) This is a significant improvement from the 16.3% decline in May.

The monthly change was down 0.5% from August, reversing the increases we saw through the summer.

The median Portland home price is now down 19.7% from the peak in July 2007.

HOW PORTLAND PRICES COMPARE TO OTHER MARKETS

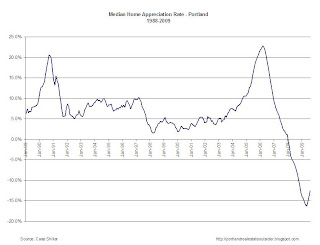

The above chart shows growth rates for Portland, Seattle, the San Francisco bay area (the other areas I consider as closest to Portland) as well as the 20-city composite index. Portland is now doing a little better better than Seattle, but note how the price declines in the Bay Area are really starting to slow.

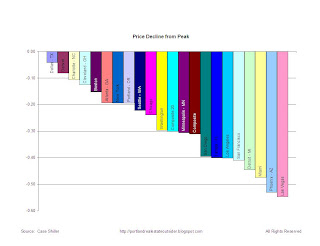

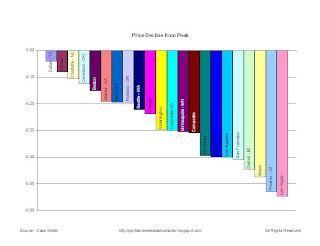

The above chart shows how Portland is faring compared to other cities. Our maximum price decline is still below average, and I'm starting to think we'll remain below average.

The above chart shows how Portland is faring compared to other cities. Our maximum price decline is still below average, and I'm starting to think we'll remain below average.CURRENT PRICES VS HISTORIC AVERAGE

This chart shows the price index for the past 8 years. This month the pink line represents an average of 4% growth starting in January 2001. That puts us right about where we are today. A year ago we were well above 5% for the past 8 years. Why 4%? Why not.

This chart shows the price index for the past 8 years. This month the pink line represents an average of 4% growth starting in January 2001. That puts us right about where we are today. A year ago we were well above 5% for the past 8 years. Why 4%? Why not.FULL PORTLAND PRICE HISTORY

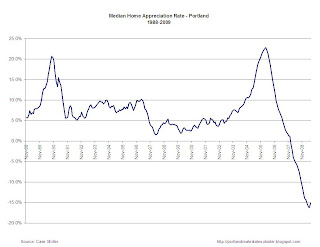

This chart shows the previous bubble in the early 90's, and also shows that Portland prices had never dropped over the past 20 years, until 2008.

This chart shows the previous bubble in the early 90's, and also shows that Portland prices had never dropped over the past 20 years, until 2008.Any thoughts on the latest stats? I'm thinking that most first time buyers have taken the plunge, and that prices will hover or drop another 5% over the winter, even with the extended tax credit.

ABOUT CASE SHILLER:

The S&P/Case-Shiller Home Price Indices measures the residential housing market, tracking changes in the value of the residential real estate market in 20 metropolitan regions across the United States. These indices use the repeat sales pricing technique to measure housing markets. First developed by Karl Case and Robert Shiller, this methodology collects data on single-family home re-sales, capturing re-sold sale prices to form sale pairs. This index family consists of 20 regional indices and two composite indices as aggregates of the regions.

Data presented in the Case Shiller spreadsheets are calculated monthly using a three-month moving average and published with a two month lag.