This truly smacks of desperation. As featured in the Portland Business Journal, "

NW markets just say no" Caldwell Banker is trying to run a national promotion for 10% off any house listed with them. However the PNW STILL thinks that we are immune, and not in as bad a shape as the rest of the country, even as prices have dropped over 7% and continue to fall.

"The Portland and Seattle affiliates of Coldwell Banker Corp. are refusing to participate in a nationwide sales promotion designed to push the housing market past the “tipping point” to recovery.

Starting today, Parsippany, N.J.-based Coldwell Banker is pushing a 10-day sales event, boasting 10 percent discounts on the price for homes listed for sale with Coldwell Banker affiliates. The campaign is being promoted nationwide, leading to confusion in markets where franchisees are refusing to participate.

In the Northwest, Coldwell Banker affiliates in both Portland and Seattle say the “sale” undercuts the role of professional agents and aren’t participating. Not only must agents take a cut in commission, but sellers receive 10 percent less than their asking price.

Gail Fisher, president of Coldwell Banker Barbara Sue Seal Properties, which has about 440 agents in the Portland area, said the national sales event is inappropriate.

“We feel that every situation for pricing for a property is very individual,” she said. “I feel it sells short the services we have to offer for our clients.”

An across-the-board 10 percent price cut isn’t right for every property and ignores the professional skills agents bring to the table when they list homes and work with sellers to set realistic prices."

There are so many things wrong with the story I don't know where to start. But I'll try.

"Starting today, Parsippany, N.J.-based Coldwell Banker is pushing a 10-day sales event, boasting 10 percent discounts on the price for homes listed for sale with Coldwell Banker affiliates. The campaign is being promoted nationwide, leading to confusion in markets where franchisees are refusing to participate."

First off, from a marketing perspective, if it's being promoted as a national promotion, it truly has to be a national promotion. Consumers aren't stupid, they can see through false claims. And you'll need a lot more than 10 days to blow out the 9+ months of inventory we're currently sitting on.

"In the Northwest, Coldwell Banker affiliates in both Portland and Seattle say the “sale” undercuts the role of professional agents and aren’t participating. Not only must agents take a cut in commission, but sellers receive 10 percent less than their asking price."

Here are the two big issues. Sellers still haven't accepted the new pricing rules, and are chasing the market down. Realtors can't do the math that says that any sale at any price is better than none, or Anything > Zero.

“We feel that every situation for pricing for a property is very individual,” she said. “I feel it sells short the services we have to offer for our clients.”

An across-the-board 10 percent price cut isn’t right for every property and ignores the professional skills agents bring to the table when they list homes and work with sellers to set realistic prices."

So Gail, just how successful have you been when it comes to setting realistic prices? If prices were set properly we wouldn't be sitting on 9 months of inventory right?

"However, Fisher said the Northwest housing market has not stalled to the same degree as the more bubble-prone regions of the country, namely Florida and California. A sale might work in a market where prices have collapsed."

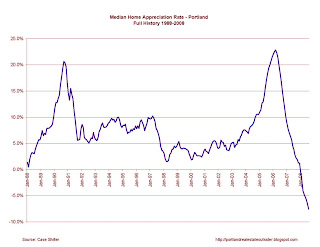

Sigh, still repeating the "we didn't have a bubble mantra" Gail? For anybody that still thinks we didn't experience a bubble, here once again is proof that we did. And while the PNW is late to the party, we're definitely at the party now.

"In Metro Portland, the median price of homes sold in August was $280,000, down about 7.3 percent from this time a year ago, according to the Regional Multiple Listing Service. Any drop in price results in a corresponding drop in the commission paid to the agents who broker the eventual sale."

This comment hides the real issue. While prices are only down 7%, sales are down over 30%, so total commissions are down over 35%. Look at what's happening to the auto industry with 30% drop in sales and you'll understand why real estate agents are freaking out. Many are making no money, and the rest are making much less. Only a few creative real estate agents who saw the impending meltdown and have changed their strategy are making any more money.

"In a video explaining the sales event, Jim Gillespie, president and chief executive officer of Coldwell Banker Co., said the event will help bring about a recovery in the housing market and help buyers take advantage of a new $7,500 tax credit available for first-time home buyers. The event will help move the market over the “tipping point” to recovery, he said."

Again, just so everyone knows, that $7500 tax "credit" is actually an interest free loan that you much pay back over 10 years. We I can't lie with my marketing but the government can is still beyond me.

"A survey of Coldwell Banker agents in the United States found that 56 percent think prices in their market are too high and that 77 percent believe their sellers have unrealistic expectations about the value of their homes.

Nearly 80 percent said when homes are priced appropriately, they attract buyers and sell faster."

Homes will not only need to be priced right, but buyers will actually need to have a real income and a real deposit. And banks will need to have access to credit to be able to offer loans. We have a long way to go before all that happens.

Thanks to

Portland Gentrification for the link.

The median price of existing homes in the metro Portland area fell 7.6 % year over year in August 2008 according to Case Shiller, continuing the trend that began in July 2007. This is down 7.8% from the peak in July 2007, wiping out any gains made since April 2006.

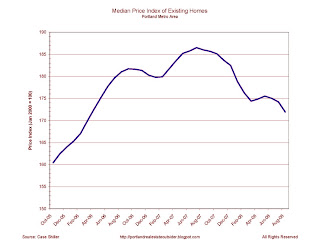

The median price of existing homes in the metro Portland area fell 7.6 % year over year in August 2008 according to Case Shiller, continuing the trend that began in July 2007. This is down 7.8% from the peak in July 2007, wiping out any gains made since April 2006. The chart above shows the price index, and you can clearly see the bubble forming in 2004, accelerate in 2005 and then start to slow in 2006.

The chart above shows the price index, and you can clearly see the bubble forming in 2004, accelerate in 2005 and then start to slow in 2006. The above chart shows Portland, Seattle, the San Francisco bay area (the other areas I consider as closest to Portland) as well as the 20-city composite index. Portland and Seattle are tracking each other nicely, still about a year behind the rest of the market. While the 20 city index has started to flatten out the San Francisco Bay area has really fallen off the cliff and continues to plummet.

The above chart shows Portland, Seattle, the San Francisco bay area (the other areas I consider as closest to Portland) as well as the 20-city composite index. Portland and Seattle are tracking each other nicely, still about a year behind the rest of the market. While the 20 city index has started to flatten out the San Francisco Bay area has really fallen off the cliff and continues to plummet. This chart above shows the price index for the past three years. You can more clearly see the seaonality, as well as the fact that prices are back to April 2006 levels and dropping.

This chart above shows the price index for the past three years. You can more clearly see the seaonality, as well as the fact that prices are back to April 2006 levels and dropping.