The median home price in

The median home price in

Chart 2 shows the year over year (YoY) price appreciation. The forecast in chart 2 is based on the assumption that the median price stays flat at $280k. If the median price drops, the YoY change will drop further. But within a few months we'll be showing negative YoY appreciation, finally catching up to the rest of the country.

Chart 2 shows the year over year (YoY) price appreciation. The forecast in chart 2 is based on the assumption that the median price stays flat at $280k. If the median price drops, the YoY change will drop further. But within a few months we'll be showing negative YoY appreciation, finally catching up to the rest of the country.

Chart 3 shows the rate of sales (sales pace) as well as the total inventory of houses. You can clearly see inventory rising while sales have dropped and the drop appears to be accelerating. Divide inventory by sales rate and you get months of sales, which currently stands at 12.8 months. In other words, if no new houses are listed, it would take over a year for all the inventory to be sold at the current sales rate.

Chart 3 shows the rate of sales (sales pace) as well as the total inventory of houses. You can clearly see inventory rising while sales have dropped and the drop appears to be accelerating. Divide inventory by sales rate and you get months of sales, which currently stands at 12.8 months. In other words, if no new houses are listed, it would take over a year for all the inventory to be sold at the current sales rate.

Chart 4 shows affordability in

Chart 4 shows affordability in

Chart 5 shows the spread between median list price and median sales price, or the “balance of reality” indicator. The drop around July 07 is due to buyers having to reduce their asking prices to find sellers as the market started to soften.

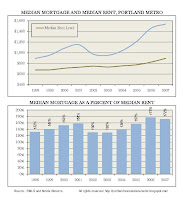

Chart 6 shows the spread of rents to mortgages. In 2002-2003 we were below the historic average, but in the past few years the spread has accelerated. Even though rents have risen recently, they haven’t risen as fast as the median mortgage payment. I expect rents to continue to increase as mortgages drop, closing the gap over the next 1-2 years. Historically the spread has ranged around 140%, and even with the recent increases in rents we're still 30% over the long term average. Expect rents to continue to increase due to apartments being converted into condos, and because more people will not be able to afford houses and will therefore be looking to rent.

Chart 6 shows the spread of rents to mortgages. In 2002-2003 we were below the historic average, but in the past few years the spread has accelerated. Even though rents have risen recently, they haven’t risen as fast as the median mortgage payment. I expect rents to continue to increase as mortgages drop, closing the gap over the next 1-2 years. Historically the spread has ranged around 140%, and even with the recent increases in rents we're still 30% over the long term average. Expect rents to continue to increase due to apartments being converted into condos, and because more people will not be able to afford houses and will therefore be looking to rent.

Stay tuned for February data, which is already shaping up to be even worse.

8 comments:

Thanks for posting this. It's funny how such data has pretty much dried up lately.

Love the data and graphs. Not too pretty a picture. When do you see the market turning positive?

i'm not ready to make an official prediction, but i believe it will be at least 18 months from the peak until we hit bottom, but i'm not sure how long we'll stay at the bottom. most respected economists i see say we're just at the beginning of the cycle, that more homeowners will get into trouble as more and more ARM's reset at higher rates, sending more houses into foreclosure and further depressing prices.

someone else commented that in their experience portland lags the california markets by 12-24 months, so keep an eye on the LA and SF markets and once they bottom out start looking for signs that we will too. so far i don't see any signs of those markets hitting bottom.

but i believe it will be at least 18 months from the peak until we hit bottom, but i'm not sure how long we'll stay at the bottom. most respected economists i see say we're just at the beginning of the cycle, that more homeowners will get into trouble as more and more ARM's reset at higher rates, sending more houses into foreclosure and further depressing prices.

Don't forget the Option ARMs which start resetting in large numbers in 2010 - the PDX market may not have been as heavy on subprime as some others, but we had a good share of Interest Only Option ARMs here (I think the number was 36% of the mortgages written here in 2006).

These types of housing price declines tend to last for several years - that's why they call them "slow motion train wrecks". I think it's at least a couple of years before we bottom out and then we'll likely bounce along that bottom for another 2 or 3 years.... Of course, that's likely the optimistic outlook, if we end up with a serious, deep recession it could be worse. If we end up with a depression - well, you know what happened last time. A lot of aspects of our current economic situation have that "perfect storm" quality to them. Heck, even Cramer said something about bank runs being almost a certainty in the near future.

Thank you for the data. My house has been for sale in CA for almost a year. I am looking at 100,000 loss. The upside is that we are renting in Portland. Our hope is that if we sell low in CA we will buy low in OR. This blog is really going to help me understand the OR market as OR realtors/sellers are still in the dark. Just like we were last fall in CA. If we had a pulse on the CA market then...we would have lowered our price earlier and been ahead of where we stand today. We have been chasing the market. My advice to OR sellers is to lower your price now because 6 months from now you are going to lose big time.

Great graphs!

You have to be a little careful in interpreting Chart 1 and extrapolating to Chart 2, though. Part of that curve fit is influenced by seasonal variation. If you cut the chart off at Jan06, the curve fit would show a similar decline and falsely predict that prices were beginning to drop. If you cut the chart off at Jan07, the curve fit would probably show a stabilization of prices, which also did not in fact turn out to happen.

I do believe that prices are bound to fall, mainly because of price/rent and affordability data. And the next few months could change Chart 1 to looking distinctively different from previous Januaries.

Several of these charts were in a presentation I saw at the homebuilder's forecast, and appear to be directly duplicated.

Yes, these charts should be attributed to Jerry Johnson or whoever actually created them.

Post a Comment