We gave up on our search for an investment property (Owner occupied duplex/triplex) late last year given that nothing "penciled out", and we didn't like the idea of negative cash flow, with or without appreciation. Without appreciation being more likely.

But I still run the numbers on the occassional duplex/triplex to test the market, and I just found one that is actually cash flow positive with 30% down, and only loses $400 a year with 20% down. Here's the ad, and the text from the ad:

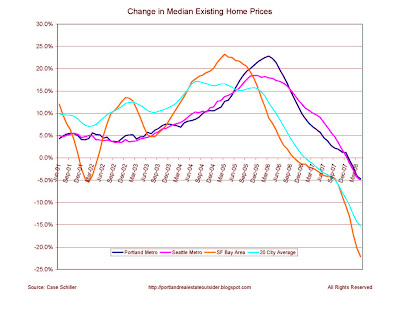

"Portland population is projected to grow by 2-4 million over the next few decades. Take advantage of this stable, fast appreciating real estate market. It's still affordable but not for long.Gotta love his optomistic view of population growth, and I'm not sure how he's definign "fast appreciating" unless he's talking about negative appreciation, but this triplex actually appears to be sanely priced.

Well maintained triplex in a convenient neighborhood. These units have desirable features that make them easy to rent (last vacancy had half a dozen applications from a single Craigslist ad). All have:

Hardwood Floors

Fireplaces

Air Conditioning

Seperate, Secure Large Storage Units

On Site Laundry

Off Street Parking

Close to Transportation

Convenient to PCC, Warner Pacific, Reed, Downtown

Over $2200 monthly income and rents could easily be raised 10% or more. Great tenants, great building in a nice neighborhood."

You will still only earn a 1.5% return on your investment the first year, but hey, at least it's positive!

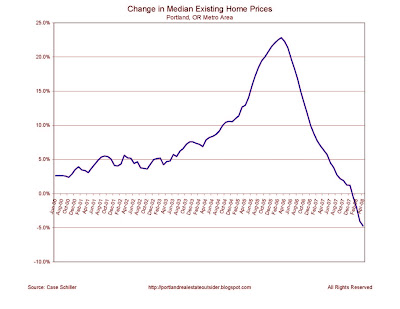

Nope, we still have a ways to go before the market has truly corrected.